On Pennies and Culture

“Culture eats strategy for breakfast” is a phrase attributed to Peter Drucker. While this concept can have both positive and negative implications, I believe that most (if not all) successful organizations share the common trait of a strong, positive company culture. A strong company culture is one that informs each employee’s decisions and actions, both technical (how they work) and relational (how they treat clients, vendors and co-workers). With a strong culture, a diverse group of people can be counted on to work and behave consistently. In organizations with a strong culture, employees tend to self-select; if they believe, they stay on and if they don’t, they leave quickly.

“Culture eats strategy for breakfast” is a phrase attributed to Peter Drucker. While this concept can have both positive and negative implications, I believe that most (if not all) successful organizations share the common trait of a strong, positive company culture. A strong company culture is one that informs each employee’s decisions and actions, both technical (how they work) and relational (how they treat clients, vendors and co-workers). With a strong culture, a diverse group of people can be counted on to work and behave consistently. In organizations with a strong culture, employees tend to self-select; if they believe, they stay on and if they don’t, they leave quickly.

If you have worked for as long as I have, you know that organizations with great culture are rare. This was my main incentive for joining Northwest Plan Services, Inc. We have a strong, unified culture. We have high standards for our processes. We are obsessed with getting it right. We have leaders who are willing to hold themselves and their teams accountable. We have commitment.

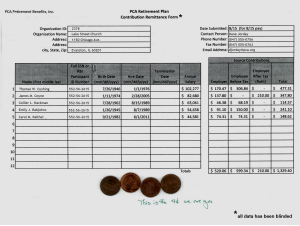

Shortly after signing on, I was walking around the office and meeting the team when I stopped by Dane Jordan’s office to introduce myself. As I sat down to chat, I noticed a piece of paper taped to his wall. The paper had a spreadsheet printed on it and 4 pennies taped to the bottom with a handwritten note. My curiosity piqued and I had to know the story behind it.

Dane is the team lead on one of our large plan clients – Presbyterian Church in America (PCA). In 2009 we won the PCA business. They were a perfect fit for NWPS because they have a high degree of complexity; so much so that many of our competitors declined to even bid. PCA’s complexity runs in two dimensions. First, they don’t exclusively use mutual funds, but instead they have custom asset class portfolios and target date funds. Second, PCA has 800 monthly payroll feeds. Each participating church and school submits their own (unconsolidated) payroll data to NWPS and contribution to the trust.

Managing 800 payroll feeds is a daunting task but we have built an efficient and effective process. We know when each payroll is supposed to arrive at our office, and when each deposit should be received at the trust. If a feed does not arrive on schedule, there will be a phone call to find out why. (You don’t have to make too many phone calls to any one organization before they put you at the top of their weekly to-do list.)

Getting payrolls in on time is half the battle. The other half is making sure the data is right. Each and every payroll goes through a series of edit and logic checks. Do the totals match? Does anyone appear on the payroll twice? Did someone disappear? Only when a payroll passes these edits do we proceed. We do not allow bad data into the system.

One of these edits triggered the “four pennies” story. Dane received the weekly payroll submission from Betty at the church in Knoxville (names changed, etc.) and he noticed that the amount wired to the trust was $0.04 different from the payroll total. So, naturally, Dane called. Betty was surprised be called on a difference of only 4 cents; but that’s how we roll. It’s either right or wrong. A few days later Dane received a copy of the payroll submission with four pennies taped to it and a note from Betty “this is the 4 cents we owe you”.

At NWPS, every plan on our recordkeeping system is reconciled to the trust positions every night. When our consultants come in to work in the morning, they have a reconciliation report for each plan. If a plan doesn’t balance to zero, then resolution is top priority. Plans either balance to the penny or there is a problem.

Recently, we were preparing for a finals presentation for a large new client (yes, thanks for asking, we won) and one of the agenda items was how NWPS manages the “clearing account” for the plan. Our team was confused by this question; perhaps taking for granted the fact we zero out the clearing account each and every night and assuming there is nothing to discuss. I explained (twice) that the incumbent vendor on this plan maintains a clearing account of over $100,000 that is reconciled quarterly and the prospect wanted to talk about it. In our organization, maintaining a clearing account balance of over $100,000 for a 401(k) plan makes no sense at all. It was a short discussion.

Because NWPS culture puts such a strong emphasis on accuracy and doing things right the first time, we almost don’t notice it. Like a fish doesn’t notice water. The truth is, our obsession with pennies (and the technical, functional and operational processes needed to enable the obsession) is a significant long-term competitive advantage. Not everyone works this way. We do, and we are proud to be obsessed with pennies.