August 25, 2015

In

Communications

Gamification for your 401(k)

At a recent 401(k) industry conference, the best session I attended was Gabe Zichermann’s session on gamification. I am familiar with the concepts of gamification but was surprised with the direction the session took. (Sidebar: Kudos to Mr. Zichermann for making sure his keynote speech was highly relevant to the audience being addressed – made a huge difference.)

Here are the basic hypotheses laid out:

- Everyone in this room (RIAs, Retirement Professionals) approaches spending differently than the general public. In this industry, we often think it is normal to defer pleasure/spending today for more pleasure/spending tomorrow. This is NOT normal. Most people are subject to Hyperbolic Discounting which means they value spending now much more heavily than they should.

- As retirement professionals, we are in the business of trying to get people to defer spending. The ENTIRE rest of the economy is in the business of trying to get people to spend NOW. It is us against the world.

- Almost all of our retirement education/communication starts with a basic premise. YOU HAVE FAILED (can anyone say “gap analysis”). This is a highly painful and negative message that normal people do not want to hear. By talking about retirement this way, we are ratcheting up the pain and driving people away.

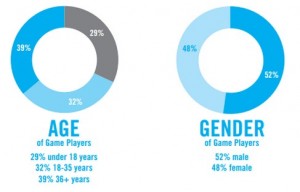

- Gaming is not just for young men. Playing games and having fun matters to all demographics and drives behavior across the population.

If we take these four hypotheses as true, then what should we change about how we do plan communications?

- Just because we think it makes sense doesn’t mean it will appeal to most people. We need a way to “normalize” the communications beyond our current perceptions.

- We are competing for $$ with Amazon, Starbucks, Walmart, Apple and Netflix. That is a high bar. The messaging needs to be really good. Positive, focused, targeted, actionable and delivered via the right channel. 12-page glossy brochures are not getting it done.

- How do we turn the messaging from fear-based to opportunity-based? How can we use gamification to enable people to quickly iterate on plan participation options and discover what works for them. We need to provide easy to use, high information, low cost ways for people to learn what will work best for them.

- We know that not everyone (I’d guess less than 10%) wants to “learn about finance” but everyone likes games – how do we incorporate this into our communication and education toolset?

Of course Plan Design matters a lot; some designs will naturally yield better retirement outcomes than others, but there is more we can do. We have to change both the messaging, and the method.